We support your investment decisions through algotraders and artificial intelligence

We work mainly with Banks, SIM, SGR, SICAV, Hedge Funds, supporting them in the management of their property portfolio

Trading Systems

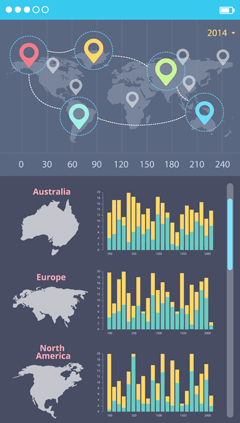

Our trading systems are based on proprietary quantitative algos, fully automated, on the financial major markets and instruments

Programming and Coding

Design and “tailor-made” programming of new indicators and genetic trading systems: definition of rules, coding, back test, live test.

Investment strategies

Study and implementation of automated investment strategies resulting from the union of different algorithms, with heterogeneous characteristics, operating on different financial markets and different time frames

Together with Nexit you will move in financial markets more consciously

We plan, test and implement trading systems based on proprietary quantitative algorithms, fully automated, able to adapt to different market scenarios, with settings “not periodically optimized” and without overfitting. Our algos select and reproduce the fittest model as an evolutionary process.

Investment strategies

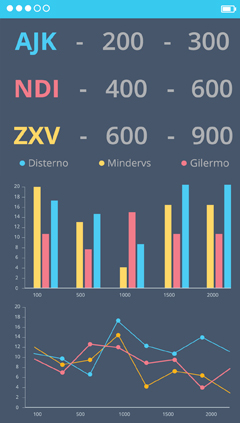

4 different investment strategies completely automated

Frozen Market

Strategy in stock index options that allows you to determine the return and volatility of your investment right from the start

Market's Hound

Dynamic strategy in futures of American stock indices, with only long positions. The algos optimize the entry timing after retracement phases

Bright Market

Dynamic and flexible strategy that takes long and short positions on the main US and European stock and bond futures. High customization possibilities for drawdown, geographical area, style and time frame

Activate your strategies now

Four steps to start now to manage the property portfolio in a fully automated way

-

Selection of

asset class -

Selection of

strategies -

Back Test

Live Test -

Strategy

activation -

Monitoring

and control -

Support

and Assistance

What are the assets you wish to invest in?

This is an initial check-up. Together we identify the markets and assets (commodities, currencies, indices, government bonds) on which to invest, we define risk tolerance levels and portfolio limits

What kind of investment strategy do you want to adopt?

We choose the strategy, or we build new ones, customized to the particular needs of your property portfolio

Back Test

We evaluate the performance report of the algorithm. Then we proceed with forward optimization and off-sample analysis. The historical price series is broken into two parts; the system trains and is optimized on the least recent part (test in sample) and then evaluated on the second part (test out of sample)

Live Test

We test our trading systems in real time for the time needed to make the appropriate assessments in terms of yield, risks and compliance with your finance policy. Only then do you choose whether to implement the strategy in your portfolio

How do you want to activate the strategy?

We can implement strategy and trading systems through different methods

Constant monitoring of strategies

We monitor the progress of the strategies and our algorithms on a daily basis, verifying the reliability of the signals and the correct functioning of the systems

We are always by your side

You can talk directly with our Research Department and our Analysts via telephone, email or chat, in a simple and fast way. A constant support to have algos always aligned with the characteristics and scenarios of the financial markets

The benefits of using algotraders

The ability to quickly and efficiently process the “big data” of the financial markets

Why do the most important global financial institutions use algorithms to manage their portfolios?

Portfolio management through quant strategies allows for fast processing of information and execution, unthinkable for a human being

Validation of a strategy or an algos

Through back tests and live tests it is possible to test a strategy, verify its functioning based on significant and robust statistical simulations, make the necessary changes

Efficient risk management

The algos allow the sizing of the riskiness of a strategy, establishing the maximum drawdown, the maximum loss, the VaR

Operating on multiple markets at the same time

The automation in the execution allows you to follow and trade more markets, decreasing the stress and bias typical of the trader